RPA is a technology that enables the connection of software, applications, and business processes. It works by capturing knowledge from the existing software system or application at the user interface level and performing programmed tasks automatically.

It brings the power of automation to organizations by increasing efficiency and accuracy through a system of virtual assistants capable of performing routine tasks traditionally carried out by human beings.

The world is getting smarter and more connected everywhere with the implementation of the Internet of Things (IoT). Businesses are now unlocking the potential of IoT to gain better results and to understand value creation.

A business could take advantage of IoT when implemented along with Software-as-a-Service (SaaS) through cloud computing. The ability to connect machines, applications, systems, and people anywhere in real-time is a significant differentiator.

As a result, IoT implementations are rapidly growing and making their way into the global business landscape.

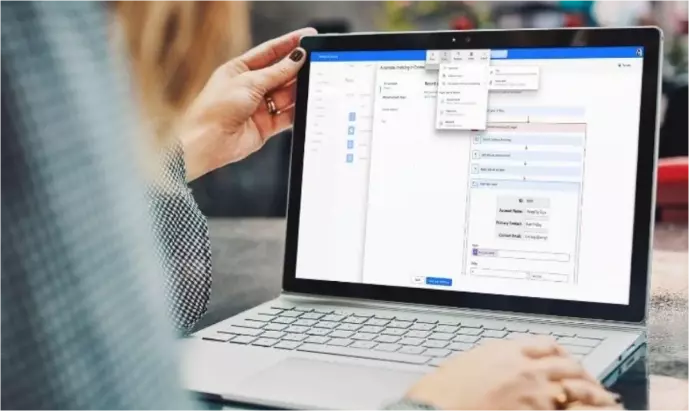

Every person can use RPA tools and technologies without any difficulty. Enterprise-grade technology with the intuitive experience of a client utility.

With bots on-demand and 500+ ready-to-download bots, it has the shortest adoption runway. Our clients have heaps of bots in motion each day. This is RPA’s pace of business.

The RPA platform with centralized controls and bank-grade security architecture exceeds the RPA security, compliance, and governance necessities for world enterprises.

Combined, RPA + AI + analytics create the most effective complete RPA platform designed to deliver an enterprise-level digital workforce.

Get support every step of the way. The Automation everywhere RPA platform is inseparable from the people devoted to your RPA achievement. A+ is a complete RPA guide environment for every step of your RPA adventure.

Setup that automates manual, repeatable assignments

As enterprises embrace digital transformation, industries realize the benefits of robotic process automation (RPA). RPA tools and services that we provide in Dubai, UAE, can strengthen businesses and make them more productive and efficient with proper planning, design, and monitoring.

Our RPA tools can easily copy the way people interact with one another. These tools can also perform routine tasks and automate processes. This minimizes the chances of errors and works to boost performance and efficiency. As a result, it brings down operational costs.

With the help of Finesse RPA consulting services, businesses can use automation to improve efficiency and cut costs. Using Finesses’s robotic process automation solutions in the UAE, organizations can transform business processes so that their human resources can focus on high-value tasks rather than mundane tasks that add no value to the business.

RPA uses a user interface to capture data and analyze tasks. It is smart enough to interpret actions and then replicates those actions to perform repetitive tasks.

Finesse, being one of the leading RPA companies, provides RPA solutions to a wide range of industries in the UAE and across the world. We have a strong focus on providing our clients with successful business process automation and optimization.

One of the key components of our RPA application is the ability to automatically transfer data from existing systems into new or replacement software platforms without having to manually enter this information.

In the healthcare industry, the right RPA solutions & services can streamline patient appointments, making patient examinations easy and hassle-free after they get discharged.

You can automate repetitive tasks with the right RPA solutions. Robotic process automation tools can help not only digitize and automate but also hasten front-end and back-end processes.

The banking sector can benefit from our RPA tools and solutions in the UAE as they can automate many processes, including operations, onboarding, servicing, mortgages, and loans.

To improve efficiency, you may automate any application procedure to streamline the process and eliminate manual labour. RPA works to simplify the application process, and improve engagement.

An in-depth look at some of the more prevalent features of RPA software:

Install, plan, examine and run your virtual team through an incredibly intuitive critical command centre on-premise or within the cloud.

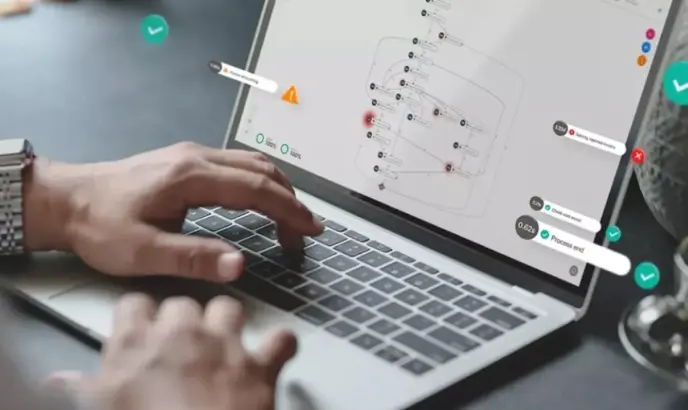

Using real-time analytics, examine and forecast operational and business metrics to build data-driven bots.

Meet the most dynamic service level agreement (SLA) demands, by optimising and prioritising both, digital as well as the human workforce.

Make enterprise continuity a non-issue through end-to-end HA/DR across bots, bot runners and monitor rooms throughout at more than one location.

Continuously check and deploy bots with dependency help, complete version control and rollback capabilities.

The most secure authentication, encryption, and credential security frameworks allow separation of duties and isolation of machines.

Nesto is a multinational company that operates a chain of hypermarkets and supermarkets. Since its establishment in 2004, the company has developed a network of more than 100 retail outlets across the GCC and India. The group attributes its rapid growth to its unwavering focus on providing its customers access to top-quality products from world-renowned...

Imdaad, the Middle East’s leading integrated facilities management company, has partnered with Finesse to automate key processes within the organisation using the ‘Automation Anywhere’ Robotic Process Automation (RPA) tool. A few key processes have been completely automated using the tool, resulting in significant improvements in process quality, greater efficiencies, and cost reductions. Incorporated in 2007,...

Finesse is deploying Automation Anywhere’s RPA solutions at Zulekha Hospital to automate the process of insurance eligibility checks of patients. The deployment is expected to have a significant impact in terms of enhancing operational efficiencies of the hospital. F inesse, a leading digital transformation solutions provider in the region is deploying an automated process for...

"*" indicates required fields

Finesse, one of the leading RPA companies in the UAE, can help businesses analyze and implement process automation faster. We have worked with many clients and helped them streamline their operations for better performance.

For more details on Robotic Process Automation (RPA) Services & Solutions in Dubai, UAE, contact us today at info@finessedirect.com

"*" indicates required fields